Image Source: Google

Introduction

Trading channels play a crucial role in the financial markets, providing valuable insights into the price movements of assets. Understanding how to effectively utilize trading channels can lead to greater success in trading and investing. By leveraging these channels, traders can make well-informed decisions and improve their overall profitability.

In this article, we will explore the power of trading channels and discuss strategies that traders can use to maximize their potential for success. Refer Link: https://www.xtrades.net/blogs/trading-scripts-and-trading-channels.

The Basics of Trading Channels

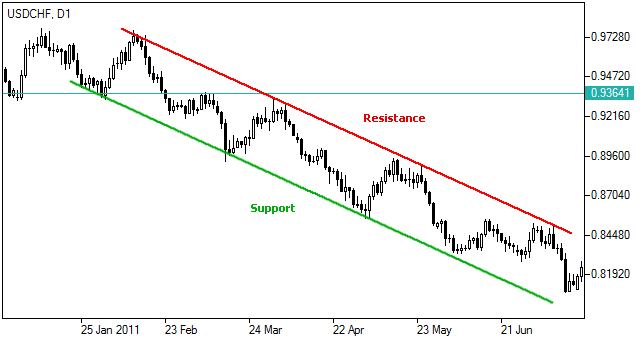

Before delving into strategies for utilizing trading channels, it is essential to understand the basics of what they are and how they work. Trading channels are graphical representations of price movements that show the upper and lower boundaries within which an asset's price tends to fluctuate. These boundaries can help traders identify potential entry and exit points for their trades.

Key Points to Note:

- Trading channels can be horizontal, ascending, or descending.

- They are created by connecting the highs and lows of an asset's price over a specific period.

- Channels can help traders identify trends and potential reversal points.

Strategies for Utilizing Trading Channels

Now that we have covered the basics of trading channels, let's explore some strategies that traders can use to leverage the power of these channels for success:

1. Channel Breakout Strategy

The channel breakout strategy involves identifying when the price of an asset breaks out of the trading channel, signaling a potential trend reversal or continuation. Traders can use this strategy to enter trades at optimal points and capitalize on price movements.

2. Support and Resistance Levels

Support and resistance levels within a trading channel can serve as valuable indicators for traders. By paying close attention to these levels, traders can make informed decisions about when to enter or exit trades, based on the price action within the channel.

3. Trend Following

Traders can also use trading channels to identify and follow trends in the market. By recognizing the direction of the channel (ascending, descending, or horizontal), traders can align their trades with the prevailing trend and increase their chances of success.

4. Using Multiple Timeframes

By analyzing trading channels across multiple timeframes, traders can gain a more comprehensive view of the market and make more informed trading decisions. This strategy can help traders identify key levels of support and resistance and anticipate potential price movements.

5. Risk Management

Effective risk management is crucial when trading channels to ensure that traders protect their capital and minimize losses. Traders should set stop-loss orders and position sizes based on their risk tolerance and the volatility of the asset they are trading.

Conclusion

Trading channels are powerful tools that can help traders navigate the complexities of the financial markets and make well-informed trading decisions. By understanding how to effectively utilize trading channels and employing the right strategies, traders can enhance their trading performance and increase their profitability. It is essential for traders to continuously educate themselves on trading channels and refine their strategies to adapt to changing market conditions. By unleashing the power of trading channels, traders can unlock new opportunities for success in their trading endeavors.